The Top 10 Tips For Currency Conversion Fees In Terms Of Exchange Rates And Rates

Conversion fees for currency are increasing in importance in the globalized world. They can be an important element for any financial transaction whether it's a travel abroad, a business overseas, or managing investments in foreign currencies. These charges can be wildly different according to the source of the service, the method of exchange and the currency involved. Knowing how to deal with these charges will assist you in saving money and make more informed decisions. Here are ten of the most beneficial tips that can assist you in reducing fees for currency conversion.

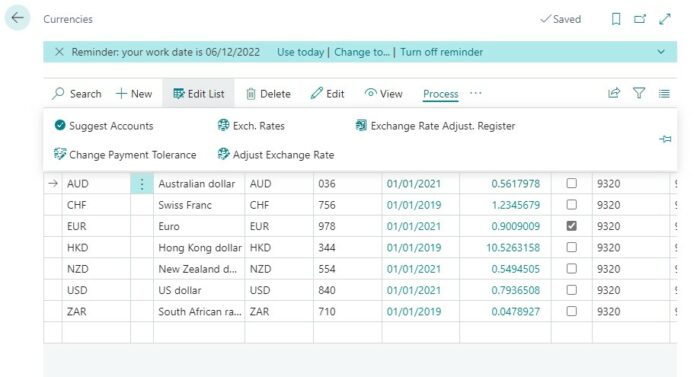

1. Learn about the different types of currency Conversion Fees

– Currency conversion fees can come in various types, such as transactions fees, service charges and markups for exchange rates. Transaction fees are fixed costs for every exchange, whereas service charges may be proportional to the amount that is converted. Exchange rate markups are incurred when the provider is able to offer a rate that is less that market rates. Understanding the various types of charges will help you determine the most cost effective alternatives.

2. Compare rates from multiple providers

It is important to evaluate the rates of various currency exchange companies before you decide to exchange your currency. Fee structures and exchange rates differ between currency kiosks, banks as well as online platforms. Use currency converters for real-time rates, and to determine the total cost, including fees. This can help you find the best deal, and also save money, particularly when you're trading large amounts.

3. Find no-cost Currency Exchange Options

Certain financial institutions and banks provide accounts that allow for free currency exchanges or reduced fees for specific transactions. Fintechs and banks that are online offer free currency conversions to their account holders. Consider opening an account with one of these companies if you regularly deal in foreign currencies.

4. Be aware of the costs associated with Dynamic Currency Conversion.

When you make a purchase using your credit or debit cards from abroad, a program named Dynamic currency conversion might give you the option of using your currency at home. While this could be convenient however, it usually comes with more conversion costs and less favorable exchange rates. Avoid these extra charges by paying in local currency. You will also benefit from the best exchange rate.

5. Make sure that your credit card does not charge foreign transaction fees.

When you travel, using credit cards that do not charge foreign transaction fees can reduce your expenses. Most travel credit cards have this advantage. It allows customers to purchase in foreign countries without incurring additional costs. Choose a card that suits your needs and offers favorable exchange rates. This will allow you to cut down on expenses while traveling.

6. Be aware of ATMs when withdrawing money

The exchange rate can be more favorable at ATMs than currency exchange booths. But beware of possible fees from your bank as well as ATM operators. If you want to save money, you should use ATMs associated with your bank. You can also withdraw cash in local currency, and avoid conversion fees.

7. Plan to prepare in Advance to convert currency

Avoid currency exchanges last minute at tourist hotspots and airports which are usually higher. Plan your currency exchange in advance to receive cheaper rates and less fees. If you're looking to cut costs on your immediate travel expenses, consider changing small amounts of money prior to departure. However, it is recommended to consider changing larger amounts to benefit from better rates upon arrival.

8. Track Trends in Exchange Rates

By keeping in mind the rate of exchange trend, you will know the most suitable time to make a the conversion of currency. You can time your currency conversions by monitoring the rate of exchange. Make use of the past data or news about financial markets to inform your decision-making, and also profit from favorable market conditions.

9. Factors that can cause hidden fees in transactions

Be aware of any hidden charges. These could include charges such as maintenance and service charges on accounts with foreign currencies. Be sure to ask questions and read the fine print to ensure that you understand all the costs of the currency exchange. This diligence may keep you from being charged unexpectedly and can assist in making financial decisions better.

10. Contact a professional in finance for transactions that are large

Get financial advice from experts when you have significant transactions or intricate exchanges of currency. Currency specialists are able to give advice on most effective practices to maximize transactions and reduce charges for conversion. This is especially important to businesses engaged in international trade or investors looking to control their currency exposure.

The following tips will help you navigate the complexities and pitfalls of currency exchange. This is especially true if you're traveling internationally, undertaking international business or managing your investment in foreign currencies. Understanding the nuances of the conversion fee will enable you to make more informed choices in financial matters that match your personal or business goals and ultimately save you money and enhancing your financial strategy. Have a look at the top us for website tips including jpy usd, dinar guru, usd to rs, usd to pkr, pound to dollar, usd to rs, usd to euro exchange rate, pound to usd, dollars to pounds, us dollar to mexican peso and more.

Top 10 Tips On Payment Methods In Relation To Currency Exchange And Rates

In today's world economy, selecting the right payment method is crucial to successfully managing financial transactions whether you are traveling abroad doing business, or evaluating investment. The selection of a payment method can significantly influence the costs, convenience, as well as security. The payment methods you choose to use are contingent on charges, exchange rates, and levels of acceptance. This could significantly impact the overall experience. Understanding the nuances behind different payment methods will help you make well-informed decisions that align with your financial goals. Here are the top 10 detailed guidelines on how to select and utilize payment methods in your financial ventures.

1. What are the available payment methods?

Know the different payment methods including cash credit/debit cards, mobile wallets, as well as digital wallets. Each method has advantages and disadvantages when it comes to convenience, fees, or acceptance. Although cash is widely accepted however it is not the most convenient and secure option for large-scale transactions. Knowing the strengths and weaknesses of each method will assist you in choosing the right one for your needs.

2. Consider Currency Conversion Fees

– Be aware of possible currency conversion charges when using your debit or credit card to make international purchases. The charges paid by credit card companies and banks can be very different. Certain cards are subject to charges for foreign transactions, however, others don't. Check with your credit card provider or bank prior to travelling abroad or making purchases, to know the policies they have regarding the cost of currency conversion. Choose cards which minimize the cost of these transactions.

3. Use credit cards with no fees for foreign transactions

If your goal is to travel overseas or make purchases in another country it is recommended to use credit cards that do not charge fees for foreign transactions. A majority of credit cards that are geared towards travel offer this feature which allows users to use their cards in foreign countries without incurring any additional charges. This can result in substantial savings, especially for frequent travelers who could also be purchasing large amounts overseas.

4. Make use of mobile payment options to leverage

Mobile payment options, such as Apple Pay and Google Pay (and other digital wallets), provide a convenient way to pay without the need of cash or credit cards. They are backed by enhanced security features like biometric authentication and tokenization, making them a secure choice for both in-person and online transactions. To reduce your expenses, you can use mobile payments to make fewer purchases.

5. Pay Attention to ATM Charges when withdrawing cash

Be conscious of ATM fees while traveling. They may be different. Some banks charge withdrawal fees for transactions that are international, while others may collaborate with other local banks to waive withdrawal fees. You can save money by looking into ATM networks with lower fees. Think about withdrawing large amounts cash at once to decrease the amount and costs of transactions.

6. Plan for alternative payment methods

If your primary method of payment does not work or gets lost, having a backup is crucial. You can make purchases with a second credit or debit card. It is crucial to have a variety of options for payment, particularly when traveling. Certain locations might not accept certain payment options. Avoid unexpected events by preparing ahead.

7. Keep track of exchange rates for better decisions

Pay attention to the exchange rate while making purchases using foreign currency so that you can make informed choices about whether to use your preferred payment method or change your money. Apps and tools that track the currency exchange rates in real time can be used to identify favorable conditions. This will allow you to decide on your method of payment.

8. Be Alert to Security Features

When you are choosing a payment method, security should be your top consideration. Check out the security features that your bank, platform or credit card company provide. Find options that offer fraud security, transaction alerts and encryption technologies. You'll be protected from fraud and unauthorized transactions by using secure payment methods.

9. Review the payment policy for companies.

Understanding the payment policies of your company is vital to managing cash flows and transactions with customers. It is essential to evaluate different payment processors based on their acceptance rates, fees and features. Choose one that's in line with your business objectives, whether it's low transaction fees, quick processing times or customer convenience. Payment methods can increase the customer experience and reduce costs.

10. Be aware of ways to pay for investment

Understanding the payment method is crucial for investors. There may be different payment methods for funding or executing accounts on different brokerage platforms. Learn about the fees and processing times associated with these methods. Consider the consequences of using margin accounts or leveraged investments, since they can impact your overall financial strategy.

Use these guidelines to help you navigate the complexities of business travel, travel, and investment with greater efficiency. Understanding payment methods such as fees, security, and charges can help you make more informed financial choices. The right payment methods can enhance your experience overall while saving you some cash and give peace of mind in your financial transactions. Check out the best CZK to EUR for blog examples including indian rupees to usd, usd to aud, thb to usd, dollar to rupee, dollar to inr, us dollar to rupees, currency exchange near me, usd to rs, yen to usd, us to peso and more.